In this document you will find:

- Capital Allowances

- Capital Taxes

- Corporation Tax

- Income Tax Rates and Bands

- Individuals

- Inheritance Tax

- Investments

- ISAs

- Land Tax Duties

- National Insurance

- Private Residences

- Tax Free Mileage Allowances

- VAT Rates

Capital Allowances

| 2021/2022 | 2022/2023 | 2023/2024 | |

| Main rate pool: writing down allowance | 18% | 18% | 18% |

| Main rate pool: Full expensing | N/A | N/A | N/A |

| Main rate pool: Super deductions | 130% | 130% | N/A |

| Special rate pool (long life assets, integral features): writing down allowance | 6% | 6% | 6% |

| Special rate pool: Full expensing | N/A | N/A | 50% |

| Special rate pool: Super deductions | 50% | 50% | N/A |

| Annual Investment Allowance (AIA) cap: | £1,000,000 | £1,000,000 | £1,000,000 |

| Structures and Buildings Allowance | 3% | 3% | 3% |

The AIA allows businesses to invest in equipment and fixtures (cars and buildings don't qualify), with 100% tax relief in the year of purchase.

The AIA cap has been permanently set at £1,000,000. If the accounting period is shorter or longer than 12-months the AIA cap is apportioned based on the length of the period.

Super deductions and full expensing can only be claimed by companies subject to corporation tax. Where either of these reliefs are claimed the items must not be pooled. When an items for which the super deduction or full expensing has been claimed is sold, it can result in a balancing charge.

Super deductions cannot be claimed for plant and machinery which is bought to be leased to another party unless it is back ground plant and machinery in leased buildings.

Capital Taxes

Enveloped Dwellings

Annual tax on Enveloped Dwellings (ATED)

The annual charges per property in each of the valuation bands are:

| Property value £ | Annual charge 2020/21 £ | 2021/22 £ | 2022/23 £ | 2023/24 £ |

| Up to 500,000 | Nil | Nil | Nil | Nil |

| 500,001 to 1,000,000 | 3,700 | 3,700 | 3,800 | 4,150 |

| 1,000,001 - 2,000,000 | 7,500 | 7,500 | 7,700 | 8,450 |

| 2,000,001 - 5,000,000 | 25,200 | 25,300 | 26,050 | 28,650 |

| 5,000,001 - 10,000,000 | 58,850 | 59,100 | 60,900 | 67,050 |

| 10,000,001 - 20,000,000 | 118,050 | 118,600 | 122,250 | 134,550 |

| Over £20,000,000 | 236,250 | 237,400 | 244,750 | 269,450 |

ATED applies where a residential property located in the UK is owned by a non-natural person such as; a company, partnership with a corporate member or a collective investment scheme.

For the years 2023/24 to 2027/28 the property valuation is its market value on 1 April 2022, or when acquired, if later. For the previous five years the property valuation point was 1 April 2017, or the date of acquisition if later.

There are a large number of reliefs and exemptions from the charge, and where such a relief applies an ATED relief declaration must be submitted. In other cases where an ATED charge is due the ATED return must be delivered to HMRC and the charge paid by 30 April within the chargeable year that runs from 1 April to 31 March.

Capital Gains Tax

The rates and annual exemption for capital gains tax are as follows:

| 2020/21 | 2021/22 | 2022/23 | 2023/24 | |

| Annual exemption | £12,300 | £12,300 | £12,300 | £6,000 |

| Annual exemption for most trustees and personal representatives | £6,150 | £6,150 | £6,150 | £3,000 |

| Rate for gains within the basic rate band | 10% | 10% | 10% | 10% |

| Rate for gains above the basic rate band | 20% | 20% | 20% | 20% |

| Gains on residential property and carried interest within the basic rate band | 18% | 18% | 18% | 18% |

| Gains on residential property and carried interest above the basic rate band | 28% | 28% | 28% | 28% |

| Rate for gains subject to Business Asset Disposal Relief | 10% | 10% | 10% | 10% |

| Lifetime limit for gains subject to Business Asset Disposal Relief | £1,000,000 | £1,000,000 | £1,000,000 | £1,000,000 |

Corporation Tax

Rates

The rates for the three financial years from 1 April 2021 are as follows:

| Year beginning 1 April: | 2021 | 2022 | 2023 |

| Corporate Tax main rate | 19% | 19% | 25% |

| Corporate Tax small profits rate | N/A | N/A | 19% |

| Marginal relief lower profit limit | N/A | N/A | £50,000 |

| Marginal relief upper profit limit | N/A | N/A | £250,000 |

| Standard fraction | N/A | N/A | 3/200 |

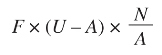

From 1 April 2023, the Corporation Tax main rate applies to profits over £250,000, and the small profits rate applies to profits of up to £50,000. Those thresholds are divided by the number of associated companies carrying on a trade or business for all or part of the accounting period. Companies with profits between £50,000 and £250,000 pay tax at the main rate reduced by a marginal relief determined by the standard fraction and this formula:

Where:

F = standard fraction

U = upper limit

A = amount of the augmented profits

N =amount of the taxable total profits

For companies with ring fence profits from oil or gas related activities, the main rate is 30%, and the small profits rate is 19%, with a ring fence fraction of 11/400, for all financial years from 2008.

Research and Development (R&D)

Small and medium (SME) companies can claim enhanced deductions for expenditure on R&D projects at 186% (230% before April 2023) of qualifying expenditure. Where the deduction is claimed and the company makes a loss, it can claim a cash credit from HMRC of 10% of that loss from 1 April 2023, previously 14.5%. Where the SME spends at least 40% of their total expenditure on qualifying R&D from 1 April 2023, it can claim the higher payable tax credit of 14.5%.

Each R&D project must be carried on in a field of science or technology and be undertaken with an aim of extending knowledge in a field of science or technology.

Research and Development Expenditure Credit (RDEC) scheme

Large companies can claim an extra 20% deduction from 1 April 2023 on the following qualifying expenditure:

- Staffing costs

- Expenditure on externally provided workers

- Software and materials consumed or transformed

- Utilities but not rent

- Payments to clinical volunteers

- Subcontractors of qualifying bodies and individuals/partnerships

RDEC differs from the previous R&D scheme for large companies as it is an 'above the line' tax credit and can be accounted for in the profit/loss statement.

Income Tax Rates and Bands

Recent income tax rates and bands are as follows:

| 2020/21 | 2021/22 | 2022/23 | 2023/24 | |

| Savings rate: 0% | Up to £5,000 | Up to £5,000 | Up to £5,000 | Up to £5,000 |

| Dividend Allowance: 0% | Up to £2,000 | Up to £2,000 | Up to £2,000 | Up to £1,000 |

| Basic rate: 20% | Up to £37,500 | Up to £37,700 | Up to £37,700 | Up to £37,700 |

| Higher rate: 40% | £37,501 - £150,000 | £37,701 - £150,000 | £37,701 - £150,000 | £37,701 - £125,140 |

| Additional rate: 45% | Over £150,000 | Over £150,000 | Over £150,000 | Over £125,140 |

When the personal allowance is taken into account an individual will start to pay tax at 40% when their total income exceeds £50,270. This threshold (and the 45% threshold) can be increased if the taxpayer pays personal pension contributions or makes gift aid donations.

Scottish Income Tax Rates and Bands

Scottish income tax applies to non-savings and non-divdend income

| 2020/21 | 2021/22 | 2022/23 | 2023/24 | |

| Starter rate: 19% | Up to £2,085 | Up to £2,097 | Up to £2,162 | Up to £2,162 |

| Basic rate: 20% | £2,086 to £12,658 | £2,098 to £12,726 | £2,163 to £13,118 | £2,163 to £13,118 |

| Intermediate rate: 21% | £12,659 to £30,930 | £12,727 to £31,092 | £13,119 to £31,092 | £13,119 to £31,092 |

| Higher rate: 42% | £30,931 to £150,000 | £31,093 to £150,000 | £31,093 to £150,000 | £31,093 to £125,140 |

| Additional rate: 46% (47% from 6 April 2023) | Over £150,000 | Over £150,000 | Over £150,000 | Over £125,140 |

Individuals

Personal Allowances

The standard personal allowance has been frozen at £12,570 for all years from 2021/22 to 2027/28.

The transferrable marriage allowance applies from 6 April 2015 to couples (married or civil partners) where neither person pays tax at the 40% or 45% rates. The spouse who cannot use all their personal allowance against their own income may opt to transfer 10% of their personal allowance to their spouse or civil partner.

The personal allowance is tapered away for individuals who have income over £100,000, at the rate of £1 for every £2 of income above that threshold.

The allowances for recent years are as follows:

Minimum married couples allowance, Marriage allowance, Income limit for allowances for Married couple’s allowance, Personal allowance removed completely at:

| 2020/21 (£) | 2021/22 (£)* | 2022/23 (£) | 2023/24 (£) | |

| Personal Allowances | £12,500 | £12,500 | £12,570 | £12,570 |

| Minimum married couples allowance | £3,510 | £3,530 | £3,640 | £4,010 |

| Maximum married couples allowance | £9,075 | £9,125 | £9,415 | £10,375 |

| Marriage allowance | £1,250 | £1,260 | £1,260 | £1,260 |

| Blind person's allowance | £2,500 | £2,520 | £2,600 | £2,870 |

| Income limit for allowances for Married couple’s allowance | £30,200 | £30,400 | £31,400 | £31,400 |

| Income limit for standard allowances | £100,000 | £100,000 | £100,000 | £100,000 |

| Personal allowance removed completely at: | £125,000 | £125,140 | £125,140 | £125,140 |

*2020/21 figures were announced in the 2020 Spring Budget and are subject to enactment.

Inheritance Tax

The inheritance tax (IHT) nil rate band (NRB) will remain frozen at £325,000 until April 2028. The rates of IHT payable on death remain unchanged at 40% or 36% where at least 10% of the net estate is left to charity.

An additional nil-rate band (the ‘residence nil rate band’ (RNRB)) applies where an individual dies after 5 April 2017 and their estate is above the NRB. The RNRB applies when the whole or part share in the deceased’s home is passed on death to direct descendants.The maximum value of the RNRB is the lower of: the value of the home passed on, and the amount in the table below

| Year of death | Value of RNRB |

| 2017/18 | £100,000 |

| 2018/19 | £125,000 |

| 2019/20 | £150,000 |

| 2020/21 | £175,000 |

| 2021/22 | £175,000 |

| 2022/23 | £175,000 |

| 2023/24 | £175,000 |

The value of RNRB is tapered away at £1 for every £2 by which the value of the total estate exceeds £2 million.This threshold is also frozen until 2027/28.

Investments

Seed Enterprise Investment Scheme (SEIS)

SEIS was introduced to encourage people to invest in companies that have just started trading by offering tax reliefs to investors that buy shares in the company.

The table below shows the income and capital gains tax reliefs that apply:

| Tax Year | 2013/14 to 2022/23 | 2023/24 |

| Rate of income tax relief | 50% | 50% |

| Maximum investment qualifying for income tax relief | £100,000 | £200,000 |

| Gains exempt from CGT relief on reinvestment in SEIS shares: | 50% | 50% |

Enterprise Investment Scheme (EIS)

EIS is available to companies that are looking to grow by offering tax reliefs to investors that buy new shares in the company.

The table below shows the income tax reliefs that apply:

| EIS | 2012/13 to 2017 | From 2018/19 |

| Rate of income tax relief | 30% | 30% |

| Maximum investment qualifying for income tax relief | £1,000,000 | £2,000,000 |

Any investment over £1 million per tax year must be invested in knowledge intensive companies.

A gain made on the disposal of EIS shares after holding them for at least three years is exempt from CGT to the extent that full income tax relief has been claimed, and not withdrawn, on the investment.

Where the disposal proceeds from any capital gain are reinvested in a subscription for EIS shares in the four-year period that starts one year before the date of the gain, all or part of the original gain can be deferred. The deferred gain is brought back into charge on the disposal of the EIS shares or on a breach of the investment conditions

Social Investment Tax Relief (SITR)

This relief was withdrawn on 5 April 2023.

The table below shows the income and capital gains tax reliefs that apply:

| SITR | 2014/15 to 2022/23 |

| Rate of income tax relief | 30% |

| Maximum investment qualifying for income tax relief | £1,000,000 |

Venture Capital Trusts (VCTs)

VCTs were introduced to encourage people to invest in companies that have just started trading by offering tax reliefs to investors that buy shares in the company.

The table below shows the income and capital gains tax reliefs that apply:

| VCT | |

| Rate of income tax relief | 30% |

| Maximum investment qualifying for income tax relief | £200,000 |

ISAs

The ISA investment limits are as follows:

| 2019/2020 | 2020/2021 | 2021/2022 | 2022/2023 | 2023/2024 | |

|---|---|---|---|---|---|

| ISA for shares and/or cash | £20,000 | £20,000 | £20,000 | £20,000 | £20,000 |

| Junior ISA and Child Trust Fund | £4,368 | £9,000 | £9,000 | £9,000 | £9,000 |

From 1 December 2015 to 30 November 2019 first time buyers could open a Help to buy ISA to help save for their first home. The Government contributed a 25% bonus, up to £3,000 per ISA payable when the funds are used to buy the home. Though phased out in November 2019 the Help to buy ISA is still operating for existing account holders.

From 6 April 2017 UK resident individuals aged between 18 and 40 may open a Lifetime ISA to save up to £4,000 per year. The Government will contribute a 25% bonus up to £1,000 per year. The funds can be withdrawn from age 60 onwards or when the saver is terminally ill. The savings may also be used to help purchase the saver’s first home worth up to £450,000, after the account has been open for at least 12 months. The Government bonus will be lost if the funds are accessed for other purposes.

Premium Bonds

Individuals may invest up to £50,000 in premium bonds. Any winnings are tax free.

The odds of winning a prize for each £1 bond number are currently 24,500 to 1. There are two £1m prizes per month. The balance of the prize fund is allocated into three value bands: 10% in the higher band ( £5000 to £100,000) , 10% in the medium band (£500 and £1000) and 80% in the lower band ( £100, £50 and £25).

Land Tax Duties

Stamp Duty Land Tax

Residential Land or property

Stamp Duty Land Tax (SDLT) is charged on transactions of land or buildings located in England or Northern Ireland. The amount due is calculated at each rate on the portion of the purchase price which falls within each rate band. The tax is payable within 14 days on the completion date of the deal.

Rates from 23 September 2022 to 31 March 2025:

| Rate | Property value band |

| 0% | Up to £125,000 |

| 5% | £250,000 - £925,000 |

| 10% | £925,000 - £1,500,000 |

| 12% | Over £1,500,000 |

From 1 October 2021 to 22 September 2022

| Rate | Property value band |

| 0% | Up to £125,000 |

| 2% | £125,000 - £250,000 |

| 5% | £250,000 - £925,000 |

| 10% | £925,000 - £1,500,000 |

| 12% | Over £1,500,000 |

From 1st July 2021 to 30 September 2021 the following rates were applied

| Rate | Property value band |

| 0% | Up to £125,000 |

| 5% | £250,000 - £925,000 |

| 10% | £925,000 - £1,500,000 |

| 12% | Over £1,500,000 |

From 1April 2016 a supplement of 3% applies where purchaser owns an interest in two or more homes at the end of the day of the transaction, and the property is not a replacement for their main home, or the purchaser is a corporate body.

First Time buyers' relief

This can apply where all the purchasers of the property have never owned an interest in a residential property.

From 23 September 2022 to 31 March 2025, first time buyers' relief applies so the first £425,000 is charged at 0%, if the total purchase price does not exceed £625,000.

From November 2017, the relief applies 0% SDLT up to £300,000, with reduced liability up to £500,000. Any purchases above £500,000 would attract the normal stamp duty rates on the whole purchase price.

Non-Residential or mixed property

| Rate from 17 March 2016 | Purchase price/lease premium or transfer value |

| 0% | Up to £150,000 |

| 2% | £150,001 - £250,000 |

| 5% | Over £250,000 |

Lease rentals

| Effective date | Residential property | Non-residential or mixed property | Rate |

| NPV of rents | NPV of rents | % | |

| From 23 September 2022 to 31 March 2025 | Up to £250,000 | Up to £150,000 | 0 |

| Over £250,000 | £150,001 to £5m | 1 | |

| N/A | Over £5m | 2 | |

| From 1 October 2021 to 22 September 2022 | Up to £125,000 | Up to £150,000 | 0 |

| Over £125,000 | £150,001 to £5m | 1 | |

| N/A | Over £5m | 2 | |

| From 1 July 2021 to 30 September 2021 | Up to £250,000 | Up to £150,000 | 0 |

| Over £250,000 | £150,001 to £5m | 1 | |

| N/A | Over £5m | 2 |

Where the chargeable consideration includes rent, SDLT is payable on the lease premium and on the 'net present value' (NPV) of the rent payable.

Where the annual rent for the lease of non-residential property amounts to £1,000 or more, the 0% SDLT band is unavailable in respect of any lease premium.

Land and buildings transaction tax

Residential Land or property

Land and buildings transaction tax (LBTT) is charged on transactions concerning property located in Scotland from 1 April 2015.

Rates from 1 April 2021:

| Main Rate | ADS rate (from 16 December 2022) | Property value band |

| 0% | 6% | Up to £145,000 |

| 2% | 6% | £145,000 - £250,000 |

| 5% | 6% | £250,001 - £325,000 |

| 10% | 6% | £325,001 to £750,000 |

| 12% | 6% | Over £750,000 |

The additional dwelling supplement (ADS) applies to the whole of the value where purchaser owns an interest in two or more homes at the end of the day of the transaction, and the property is not a replacement for their main home, or the purchaser is a corporate body. The ADS may apply to mixed-use properties where the non-residential rates apply.

Non-Residential or mixed property

| Rate from 7 February 2020 | Purchase price/lease premium or transfer value |

| 0% | Up to £150,000 |

| 1% | £150,001 - £250,000 |

| 5% | Over £250,000 |

Lease rentals

| Rate from 7 February 2020 | NPV of rents |

| 0% | Up to £150,000 |

| 1% | £150,001 to £2 million |

| 2% | Over £2 million |

Land Transaction Tax

Land transaction tax (LTT) applies to transactions of land and property located in Wales from 1 April 2018

Residential property

Rates from 10 October 2022

| Wholly residential property value: | Main rate % | Wholly residential property value: | Higher rates % |

| Up to £225,000 | 0 | Up to £180,000 | 4.0 |

| £225,001 - £400,000 | 6.0 | £180,001 - £250,000 | 7.5 |

| £400,001 - £750,000 | 7.5 | £250,001 - £400,000 | 9.0 |

| £750,001 - £1,500,000 | 10.0 | £400,001 - £750,000 | 11.5 |

| Over £1,500,000 | 12.0 | £750,001 - £1,500,000 | 14.0 |

| Over £1,500,000 | 16.0 |

The higher rates apply to purchases of residential property for £40,000 or more, by an individual or connected individuals that already own one or more other properties, or where the purchaser is a company.

Non-residential and mixed use.

Rates from 22 December 2020

| Purchase price | Rate for freehold purchase or lease premium |

| Up to £225,000 | 0% |

| £225,000 to £250,000 | 1% |

| £250,000 to £1 million | 5% |

| Over £1 million | 6% |

Lease rentals

| NPV of rents threshold | Rate |

| Up to £225,000 | 0% |

| £225,000 to £2 million | 1% |

| Over £2 million | 2% |

National Insurance

The rates and thresholds for National Insurance Contributions for 2024/25 are:

| Class: | Monthly earnings | Rate |

| Employer Class 1 above Secondary threshold | Over £758 | 13.8% |

| Employee's class 1 | £1048 to £4189 | 10% |

| Employee's additional class 1 | Over £4189 | 2% |

| Self-employed class 2 (per week) | N/A | £3.70 |

| Share fishermen class 2 (per week) | N/A | £4.10 |

| Volunteer development workers class 2 | N/A | £6.15 |

| Class 3 (per week) | N/A | £17.45 |

| Annual profit thresholds | ||

| Self-employed class 2 | Over £12,570 credit available if profits between £6725 and £12,570 |

|

| Self-employed class 4 | £12,570 to £50,270 | 8% |

| Self-employed class 4 additional rate | Over £50,270 | 2% |

Private Residences

Main residence relief (also known as ‘principal private residence’ relief (PPR)) provides relief from capital gains tax on the disposal of (or of an interest in) a dwelling which has been the individual’s only or main residence, and on land enjoyed with that residence as its garden or grounds up to half a hectare, or more if the additional land is required for the reasonable enjoyment of the property.

The relief is time apportioned for periods of occupation, and for certain periods of deemed occupation. In particular, relief for the final 9 month period of ownership is given, if the property was at some time the individual’s only or main residence.

Where two or more properties are owned, the taxpayer may elect, within certain time limits, which property is to be treated as his main residence.

Married couples and civil partners may have only one main residence at any time between them which qualifies for the relief.

Tax Free Mileage Allowances

| First 10,000 business miles in the tax year | Each mile over 10,000 miles in the tax year | Extra passenger making same trip | |

| Cars and vans | 45p | 25p | 5p |

| Motorcycles | 24p | 24p | N/A |

| Bicycles | 20p | 20p | N/A |

These rates represent the maximum tax-free mileage allowances for employees using their own vehicles for business. Any excess is taxable. If the employee receives less than the statutory rate, tax relief can be claimed on the difference.

VAT Rates

The VAT rates and thresholds are as follows:

| From | 1 April 2019 | 1 April 2020 | 1 April 2021 | 1 April 2022 | 1 April 2023 |

| Lower rate | 0% | 0% | 0% | 0% | 0% |

| Reduced rate | 5% | 5% | 5% | 5% | 5% |

| Standard rate | 20% | 20% | 20% | 20% | 20% |

| Registration turnover | £85,000 | £85,000 | £85,000 | £85,000 | £85,000 |

| Deregistration turnover | £83,000 | £83,000 | £83,000 | £83,000 | £83,000 |

| Acquisitions from EU member states, registration and deregistration threshold | £85,000 | £85,000 | £85,000* | £85,000* | £85,000* |

* From 1 January 2021 this is only relevant for supplies of goods into Northern Ireland.

For the period 15 July 2020 to 30 September 2021 there was a temporary 5% reduced rate of VAT for certain supplies of hospitality, hotel and holiday accommodation, and admissions to certain attractions. From 1 October 2021 to 31 March 2022 these supplies were subject to VAT at 12.5%.