Corporation Tax

Rates

The rates for the three financial years from 1 April 2021 are as follows:

| Year beginning 1 April: | 2021 | 2022 | 2023 |

| Corporate Tax main rate | 19% | 19% | 25% |

| Corporate Tax small profits rate | N/A | N/A | 19% |

| Marginal relief lower profit limit | N/A | N/A | £50,000 |

| Marginal relief upper profit limit | N/A | N/A | £250,000 |

| Standard fraction | N/A | N/A | 3/200 |

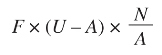

From 1 April 2023, the Corporation Tax main rate applies to profits over £250,000, and the small profits rate applies to profits of up to £50,000. Those thresholds are divided by the number of associated companies carrying on a trade or business for all or part of the accounting period. Companies with profits between £50,000 and £250,000 pay tax at the main rate reduced by a marginal relief determined by the standard fraction and this formula:

Where:

F = standard fraction

U = upper limit

A = amount of the augmented profits

N =amount of the taxable total profits

For companies with ring fence profits from oil or gas related activities, the main rate is 30%, and the small profits rate is 19%, with a ring fence fraction of 11/400, for all financial years from 2008.

Research and Development (R&D)

Small and medium (SME) companies can claim enhanced deductions for expenditure on R&D projects at 186% (230% before April 2023) of qualifying expenditure. Where the deduction is claimed and the company makes a loss, it can claim a cash credit from HMRC of 10% of that loss from 1 April 2023, previously 14.5%. Where the SME spends at least 40% of their total expenditure on qualifying R&D from 1 April 2023, it can claim the higher payable tax credit of 14.5%.

Each R&D project must be carried on in a field of science or technology and be undertaken with an aim of extending knowledge in a field of science or technology.

Research and Development Expenditure Credit (RDEC) scheme

Large companies can claim an extra 20% deduction from 1 April 2023 on the following qualifying expenditure:

- Staffing costs

- Expenditure on externally provided workers

- Software and materials consumed or transformed

- Utilities but not rent

- Payments to clinical volunteers

- Subcontractors of qualifying bodies and individuals/partnerships

RDEC differs from the previous R&D scheme for large companies as it is an 'above the line' tax credit and can be accounted for in the profit/loss statement.

For more information see our ...